Weekly musing: the etfuture is here.

Following this weekend’s ETForia newsletter, it’s time for the last pre-ETF approval newsletter, this time discussing the scenarios around this highly anticipated moment. Because even if everything will most likely go according to plan, FUD is still here.

Why? The natural response to euphoria is that something isn’t right. Even though such elation is still quite contained to some sectors of the market, many around me also agree that things are hot and it would be better if they weren’t. Why?

Because I expect 2024 to be a wild year, perhaps as interesting as 2017. But in 2017 we had 5 major +30% crashes on the highway to heaven. And it would be better to have a more sustainable run this time, due to the spotlight being cast on crypto.

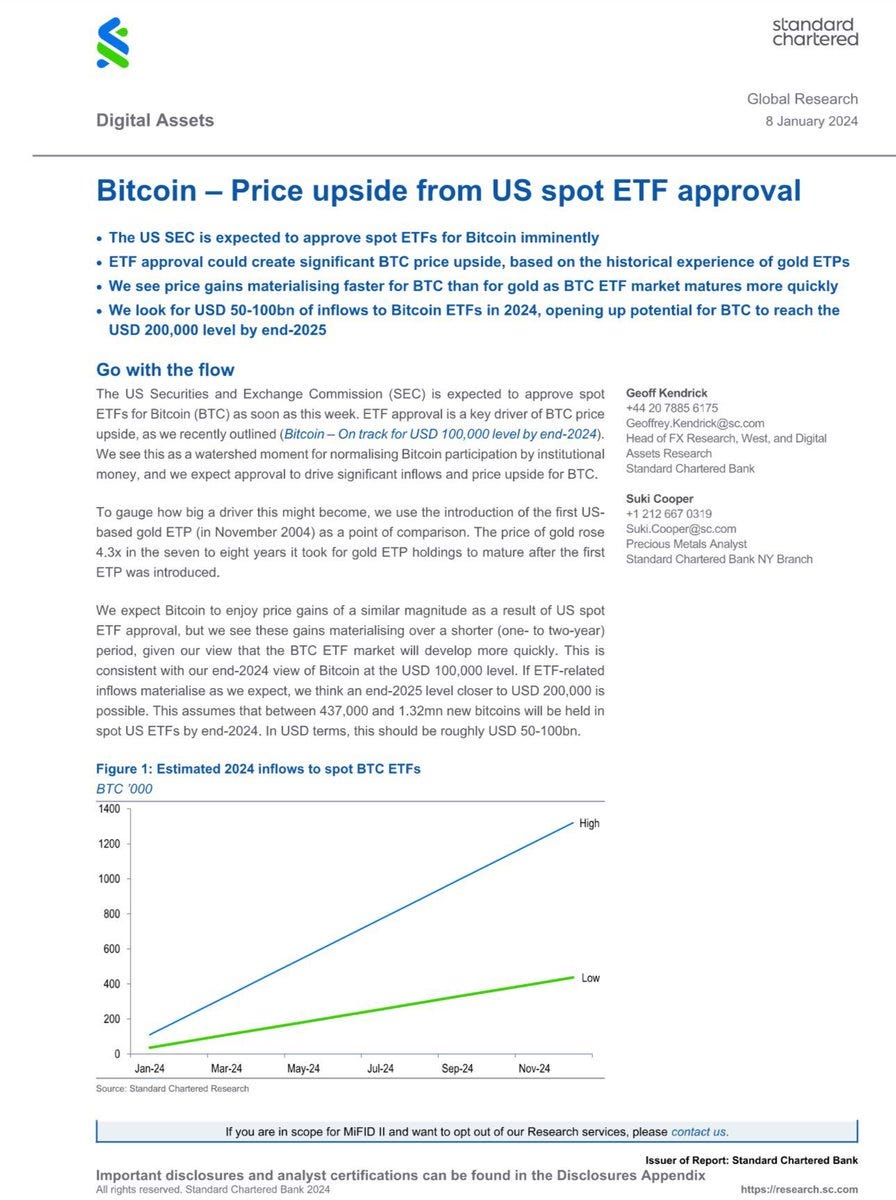

After all, even major TradFi institutions are arguing that BTC will hit $200k in 2025, a reasonable target if we think it’s “just a 3x” from its 2021 ATH of $66k and the orange coin is currently just 45% away from hitting that level again.

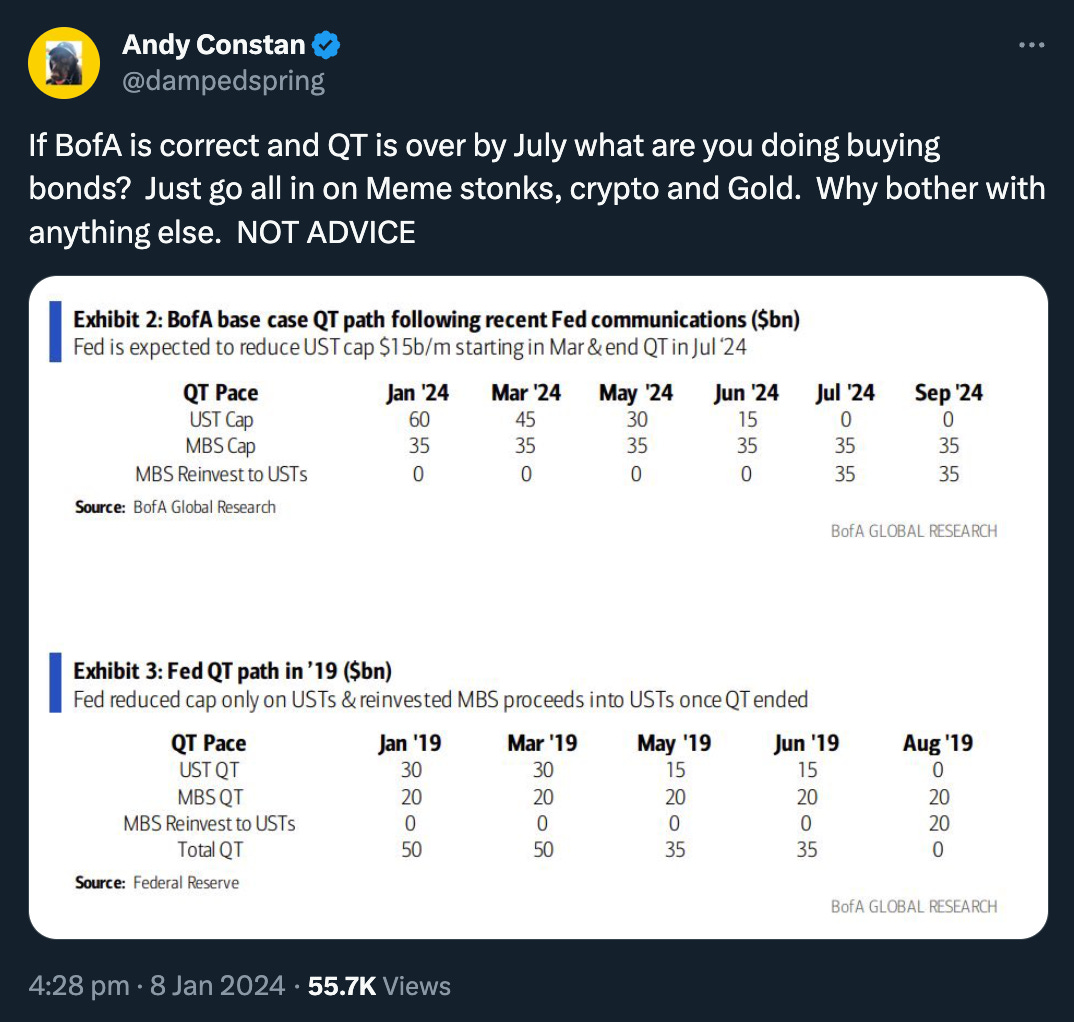

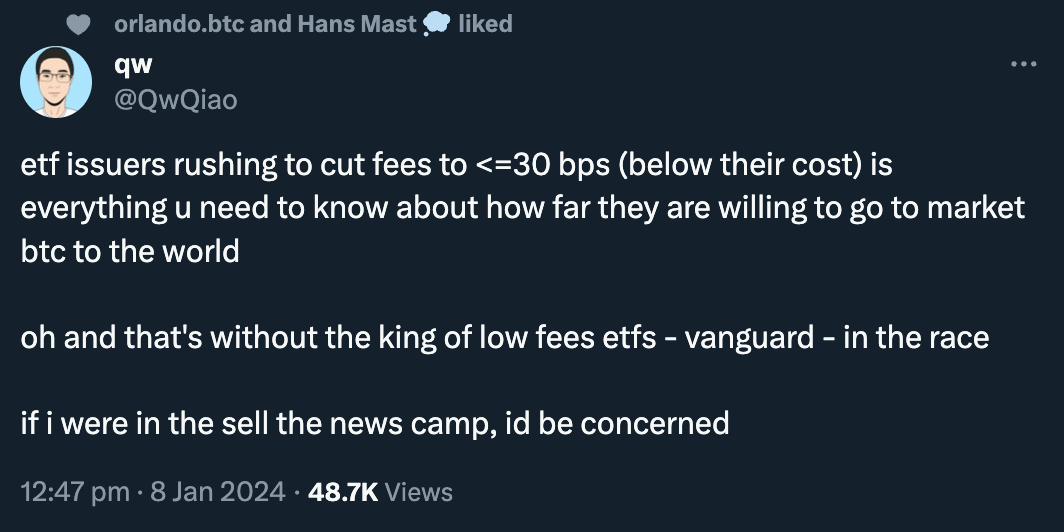

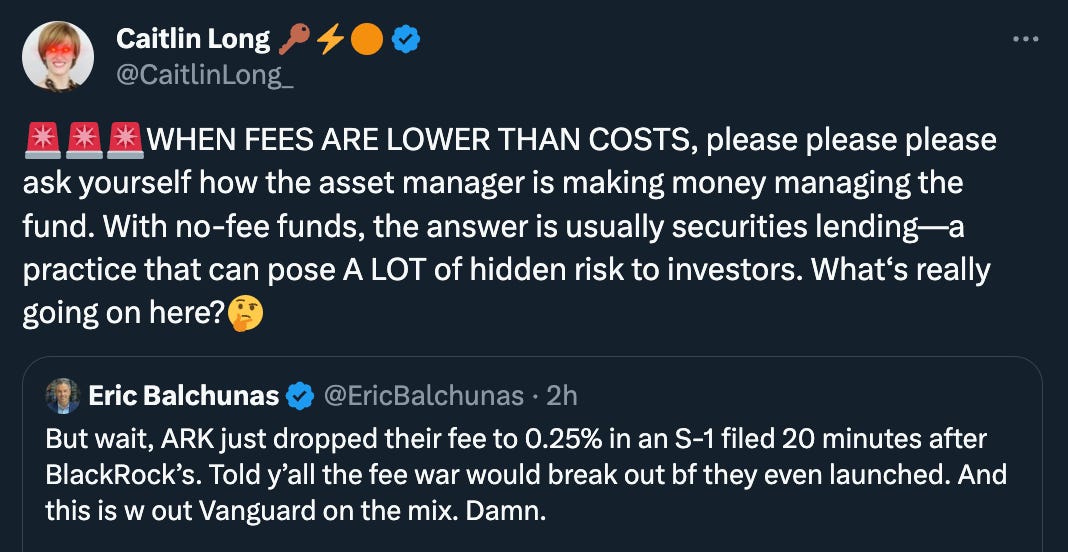

Moreover, as everyone’s discussing, it seems there’s an ETF fee war that hints at an upcoming marketing war, as I’ve written here before. This competition hints at solid demand ahead of us. Naturally, even this factor is breeding FUD!

However, even though Caitlin is a well-respected industry figure, Occam’s razor is at play here. Lower fees don’t indicate the ETF providers will go short against their holders. It just means the 11 players are competing to win this game.

Lastly, yesterday the SEC Chairman posted a thread urging caution regarding crypto investments. While some saw it as a sign the ETFs would be denied, this is standard practice before a new asset class enters the regulated, TradFi stage.

So, what’s next? If the ETFs are (unlikely) denied, crypto will crash for a while but explanations will be demanded and once there’s clarity we can go up. If the ETFs are approved tomorrow, it’s time to ride the euphoria until things start to boil!

Chart art: TradFi is here.

Three things: the score is here.

Coinbase and Glassnode released their 2024 guide to crypto markets.

Reflexivity Research shared a report about Sei, a popular ETH killer and more.

Eric Wall reviews his 2023 predictions, what a nice way to recap what happened!