By far the wildest Feb. to March transition ever

Trump announced the USA was buying the dip but the bounce was more of a dead cat

Weekly musing: two reserves this month.

What a way to end February. I told you we needed a reset after BTC lost the $95k support last week. And that’s what we got, with the orange coin hitting $78k on the monthly close, while alts capitulated. What’s next after today’s second tap of $78k?

First, what happened? A few days before the (first) crash, Arthur Hayes accurately anticipated the capitulation we saw on February 28th. Even if BTC didn’t drop that far into the highlighted support zone, there were many local bottom signals.

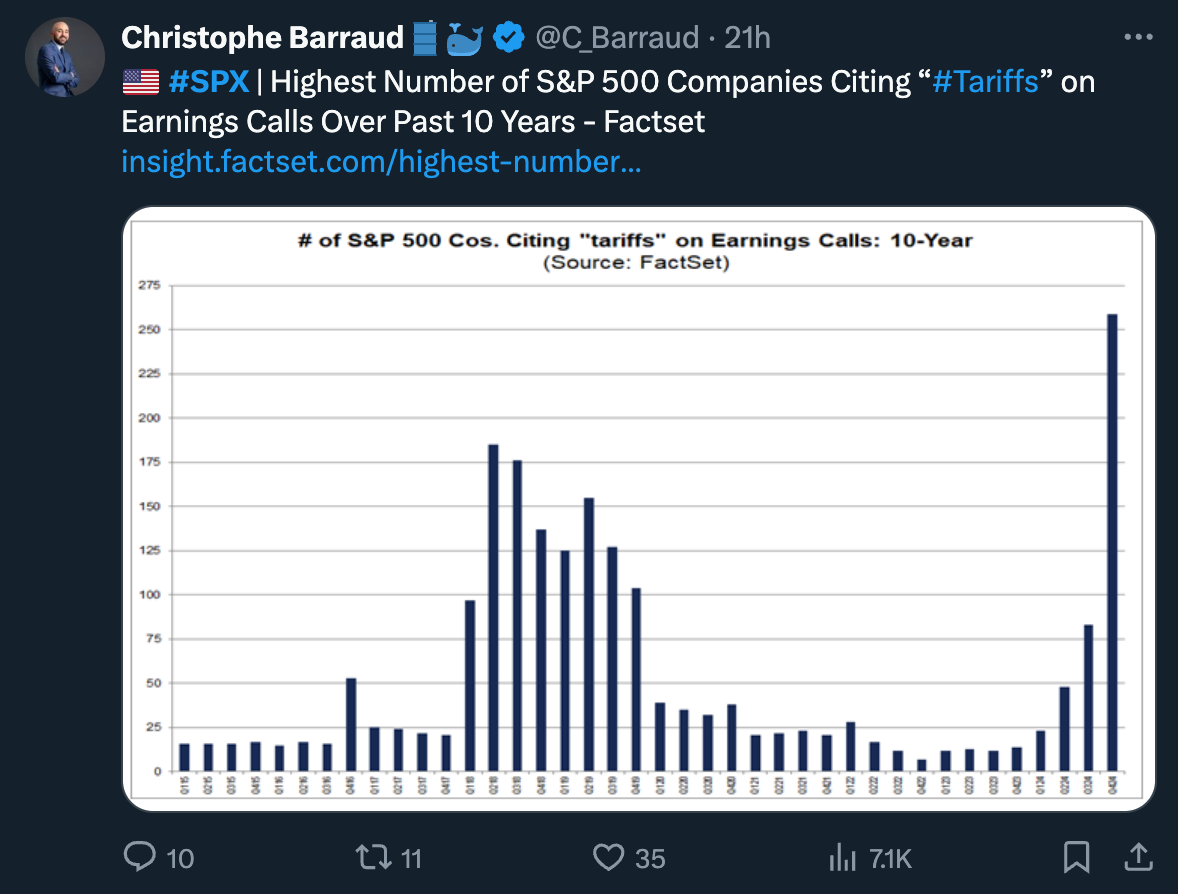

Secondly, why did it happen? On the macro side, the US dollar index had suffered the largest weekly loss since 2022, on concerns that Trump’s trade war will harm the economy. The S&P 500 and the Nasdaq 100 also crashed for the same reason.

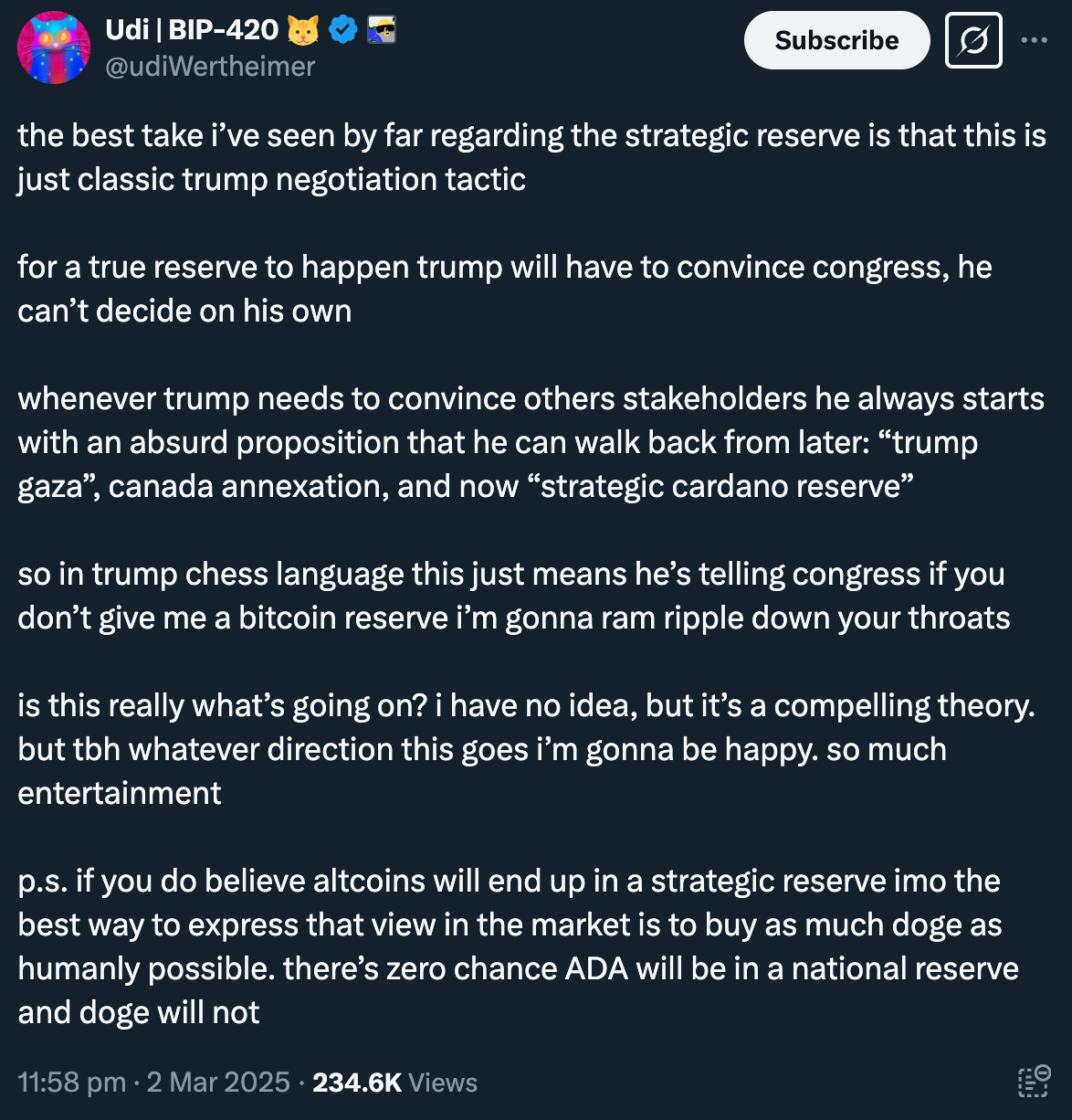

And, on the crypto side, there was plenty of disappointment around Trump’s first “digital asset stockpile” announcement, which included alternative cryptoassets such as ETH, SOL, XRP and ADA — to the dismay of many crypto OGs.

It seems Udi’s comments below were rather prescient, as a senior official later said Trump “just gave five examples of cryptocurrencies”. “Art of the deal” or not, true crypto believers disliked the idea because it involved more public spending.

All that was later corrected in anticipation of last Friday’s Crypto Summit at the White House, when Trump signed the “Strategic Bitcoin Reserve and US Digital Asset Stockpile” Executive Order the day before, focused on seized coins.

Remember the US holds between 187k to nearly 210k seized bitcoins, depending on the sources, as well as many seized alts. That was equivalent to $21 billion USD when BTC was at $100k, or roughly $17 billion at today’s prices. Not bad!

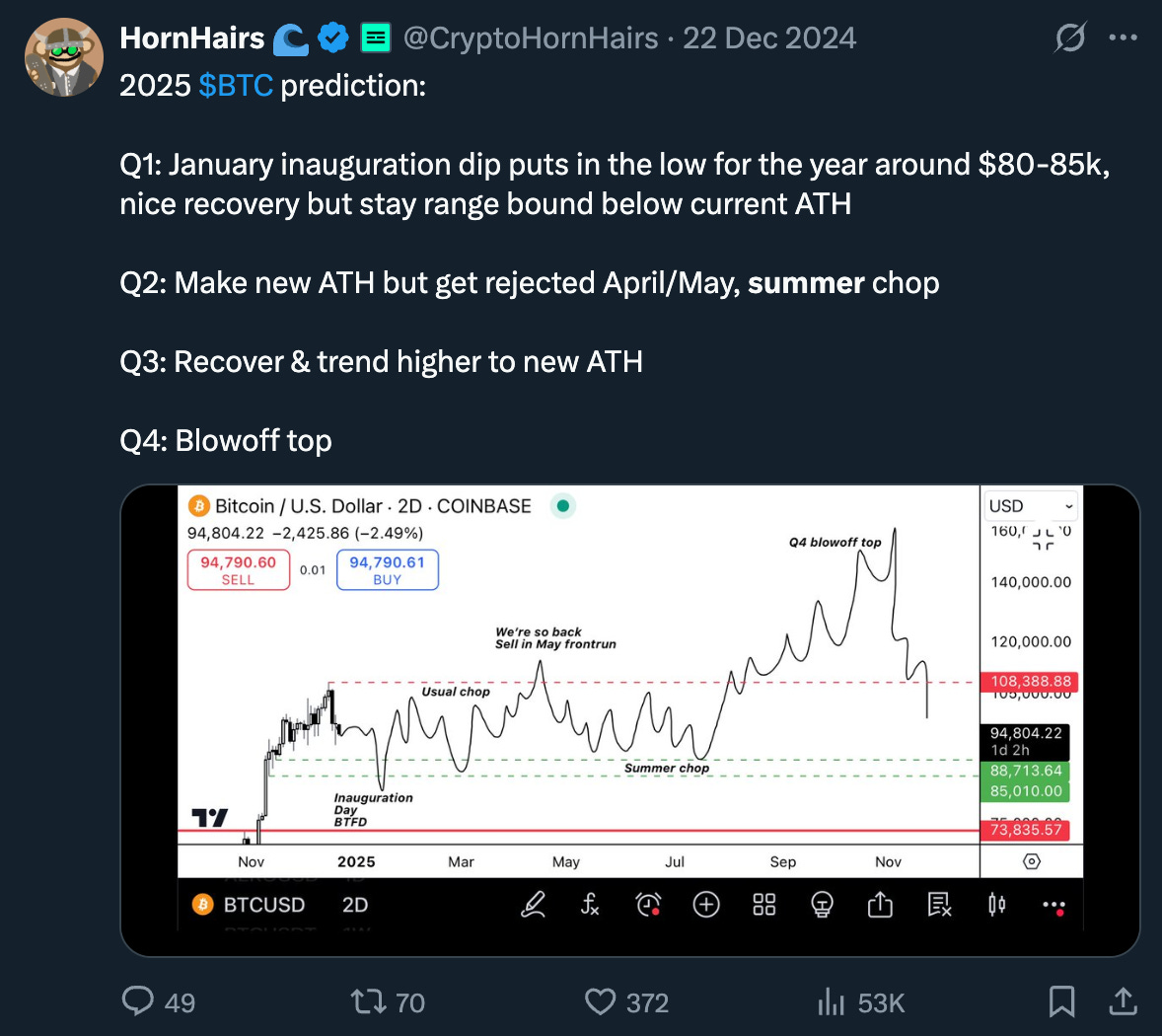

Lastly, what’s next? Well, the market bounced back last weekend after the end of February crash. But it has been falling (hard) since, despite this week’s new bullish political stance, with bitcoin briefly testing $76k this Tuesday. Not good!

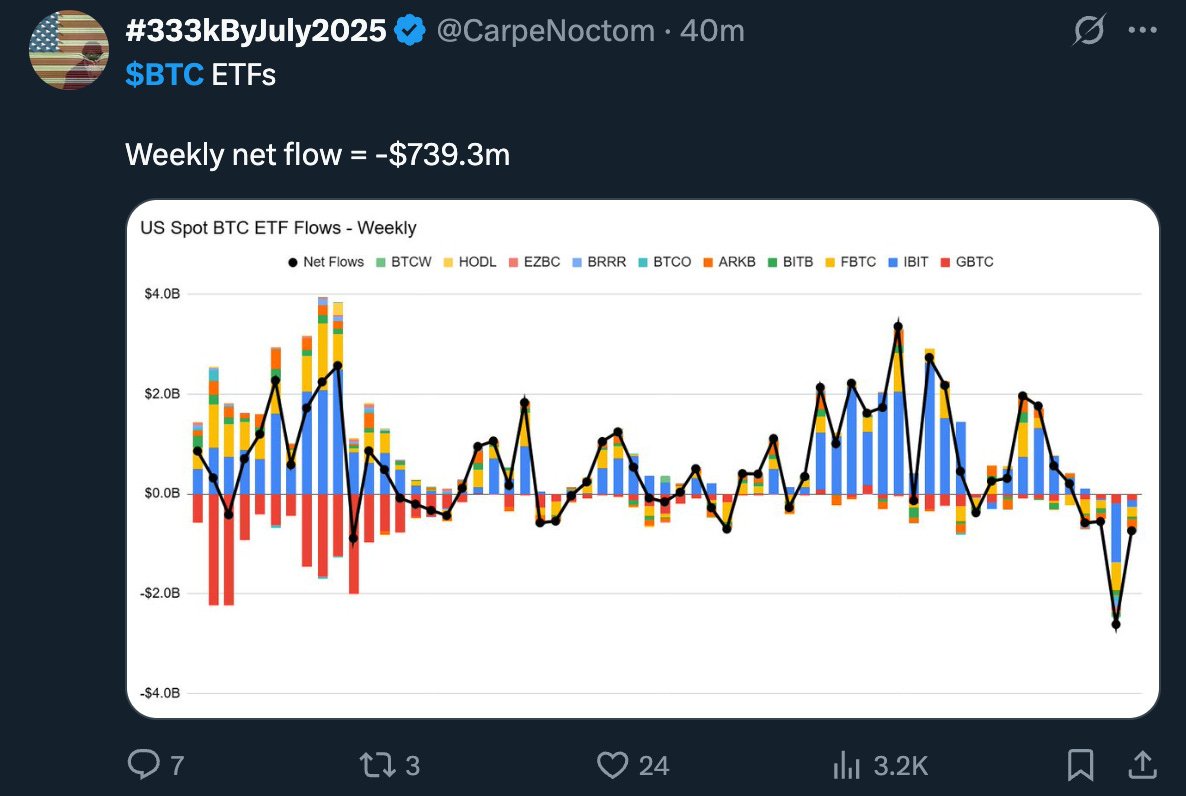

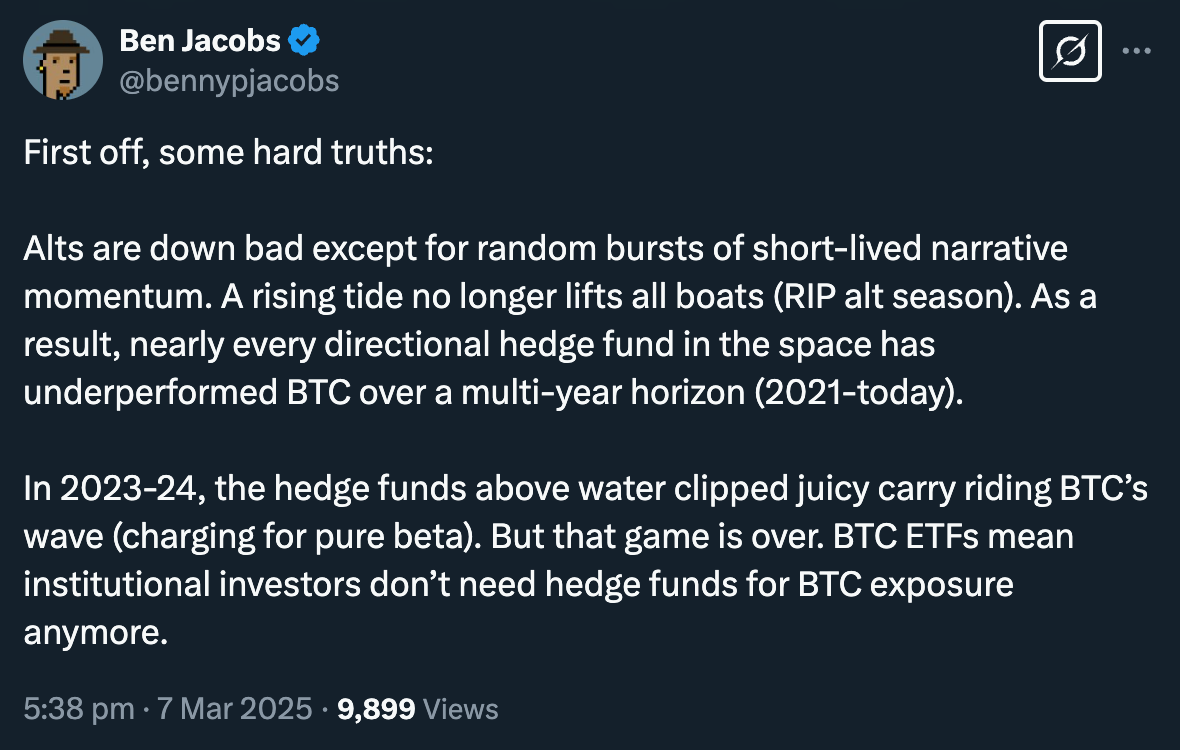

Overall, ETF investors have been cashing out at record levels — just as TradFi’s been pulling money from equities. Now fear will likely reign until the summer doldrums kick in and will only change when Trump changes his macro stance.

Things look great for the upcoming years, but until the USA figures out how to balance foreign policy with domestic markets, it will be tough for crypto to escape the short-term volatility and chop. As always, be patient and hodl!

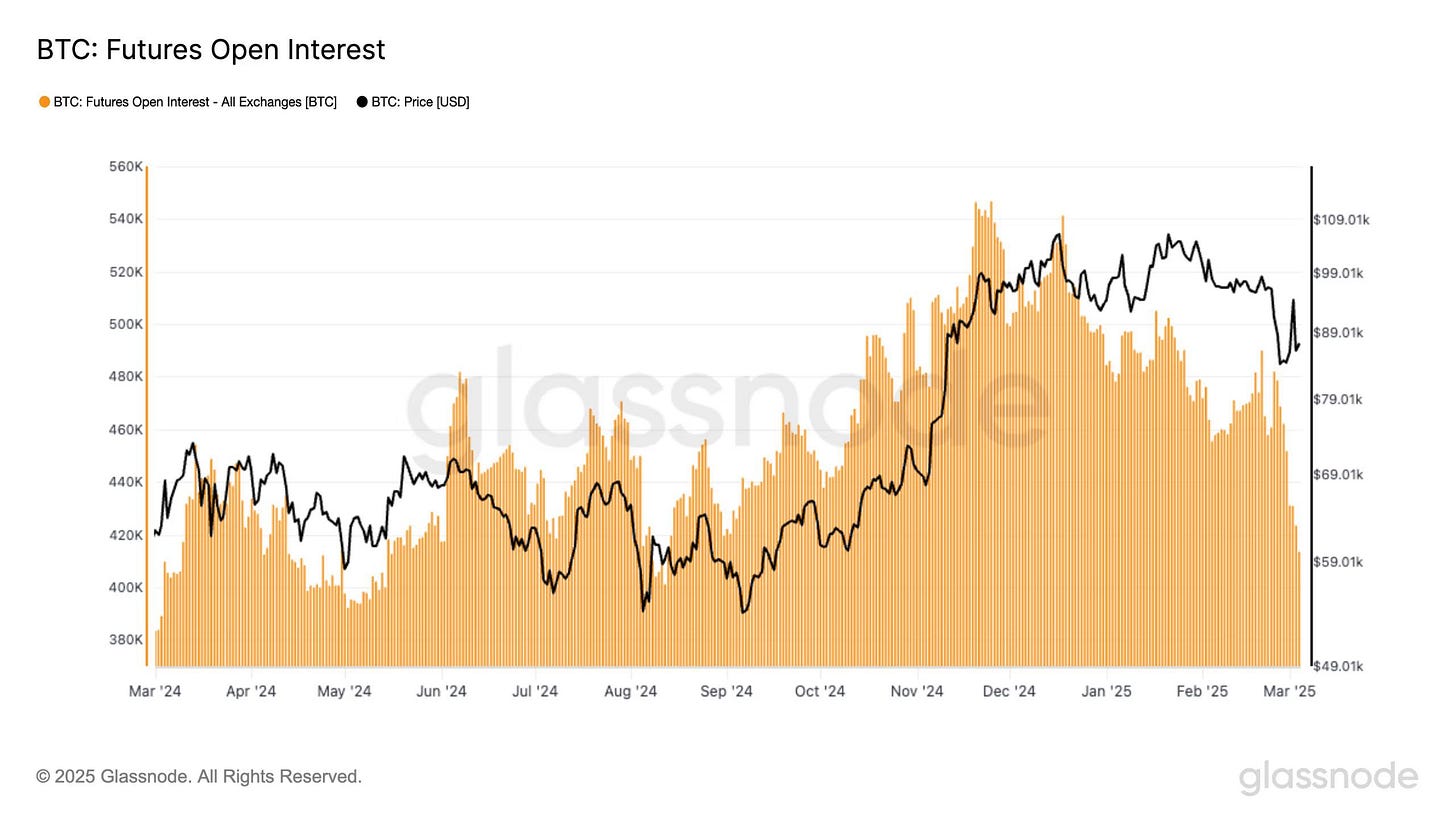

Chart art: lack of interest this week.

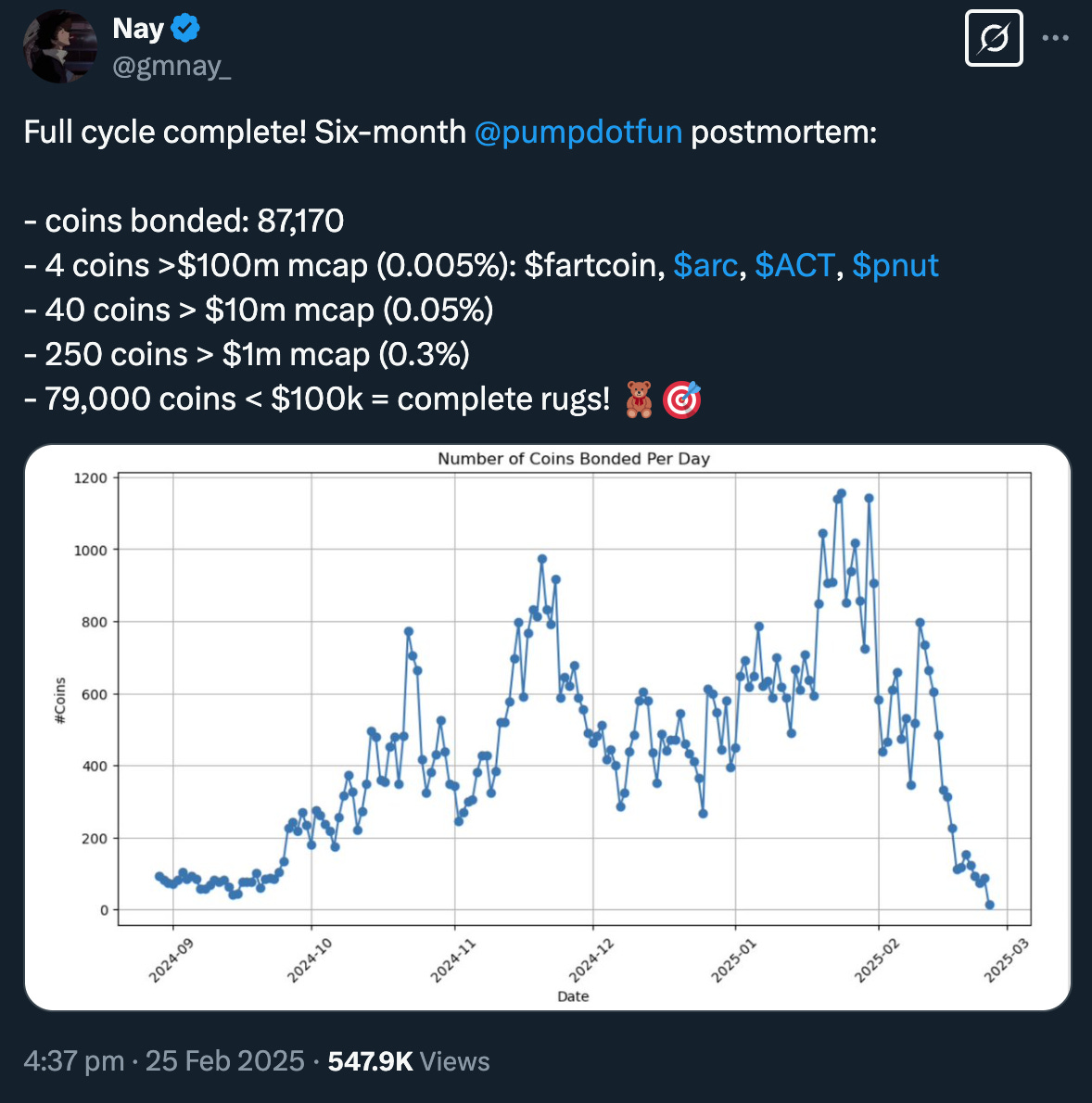

Three things: demand for stability this year.

Derek Edwards explains why blockchains are the best digital sandboxes of the internet.

Emin Gün Sirer explains why the White House crypto summit was a watershed moment.

Nemi explains the risks and rewards with yield-bearing stablecoins.