A Bitcoin-backed world

16 years in, the world needs Bitcoin more than ever.

Weekly musing: bitcoin-backed societies.

BTC hasn’t yet surpassed May 22nd’s all-time high. Alas, it even tested $100k this Friday, a 10% decline from the top — a consequence of Musk and Trump’s spectacular break-up. The drama reminded me that the world needs Bitcoin more than ever. Why?

While I enjoy volatility in general, it’s clear that the infrastructure governing our society is increasingly fragile. Inflation is just the tip of the iceberg. And Bitcoin’s potential impact lies in transcending the ego-driven instability rocking our world.

For now, that impact manifests mostly through financial adoption, which naturally underscores its long-term societal implications. The key to unlock those is the evolving Bitcoin DeFi ecosystem. So today we’re talking BTC-backed loans.

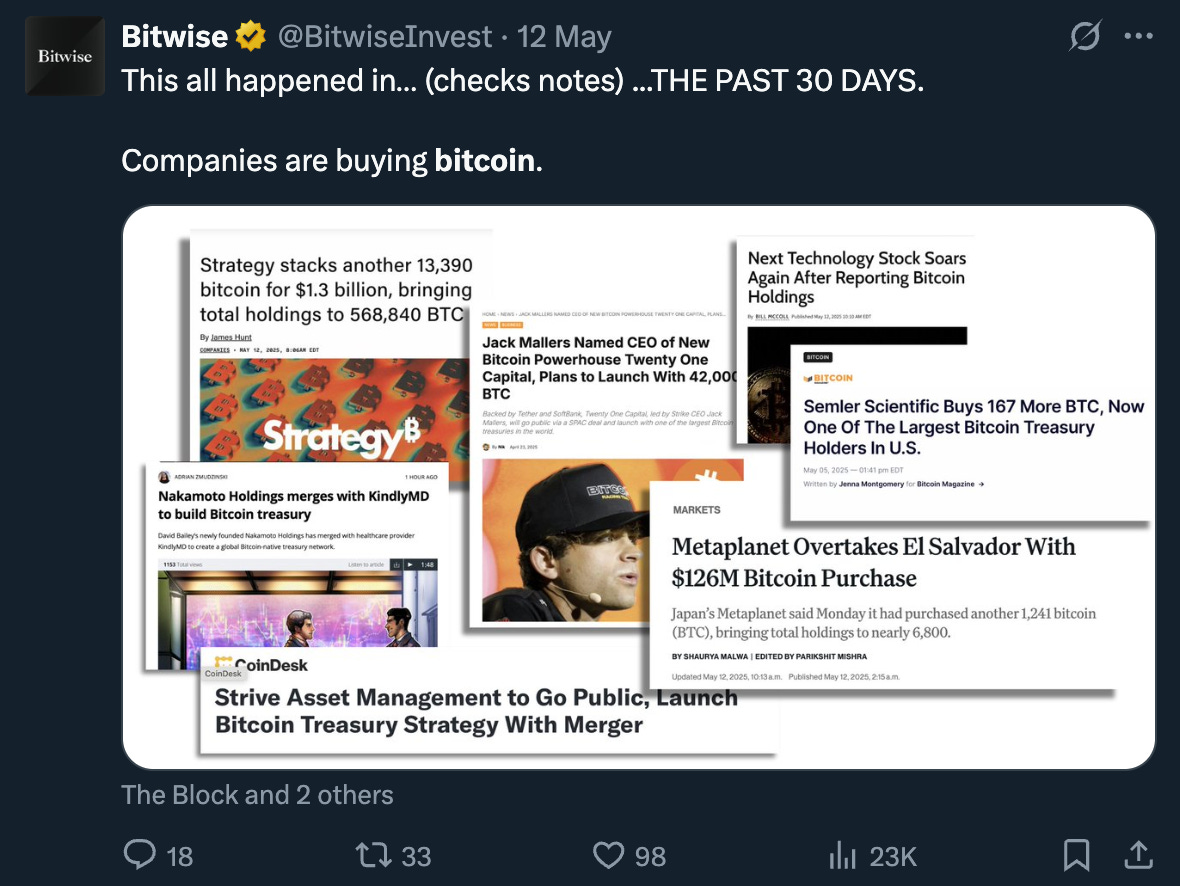

BTC-backed loans aren’t new but remain the cornerstone of BTC DeFi, given that few want to sell. Their popularity is rising again, with several players entering the market to help make corn more productive, including non-custodial solutions!

On the one hand, the expectation of clear regulation is bringing these products back into the limelight. On the other, ETH’s depressed price reminds many folks that the original cryptoasset can also be interesting — kicking off the flywheel.

This desire to put BTC to work is then a major driver for stablecoin adoption. We’re also seeing new bitcoin-to-stablecoin lending startups, not to mention BTC-based stablecoins! And all this helps TradFi align incentives with crypto.

How so? Many fintech leaders still don’t think stablecoins are sufficiently disruptive. However, TradFi understands loans quite well. As the lending profits FOMO kicks in, institutions will be naturally shown the way of the future!

Overall, the industry is stronger than ever and that strength is trickling down. First to financial institutions and then, hopefully, to the world at large. After all, no one can compete against efficiency; you either embrace it or get disrupted.

Chart art: bitcoin-backed fintechs.

Three things: bitcoin-backed models.

Blockhiro explores bitcoin’s emerging role beyond a simple store of value.

Jon Ma drafted a wild financial model for Tether based on Circle’s IPO.

Thiccy suggests a way for sceptics to analyse bitcoin’s fundamental value.